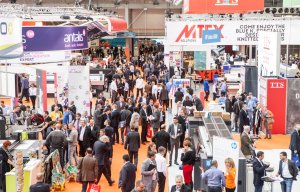

FESPA returns to Munich for 2021

Opinion

The growth of digital textile printing to date has largely been down to applications for ‘soft signage’. Promotional banners and displays and other wide-format applications – as was much in evidence at Fespa 2013, which celebrated its 50th anniversary at London’s Excel at the end of June. There are a number of companies now specialising in technical textiles for such wide-format applications, including Germany’s Heytex and Junkers & Müllers, the UK’s John Heathcoat and Cooley in the USA (whose materials were employed in the design of the 2012 Olympic stadium in London).

5th August 2013

Adrian Wilson

|

The growth of digital textile printing to date has largely been down to applications for ‘soft signage’ – promotional banners and displays and other wide-format applications – as was much in evidence at Fespa 2013, which celebrated its 50th anniversary at London’s Excel at the end of June.

There are a number of companies now specialising in technical textiles for such wide-format applications, including Germany’s Heytex and Junkers & Müllers, the UK’s John Heathcoat and Cooley in the USA (whose materials were employed in the design of the 2012 Olympic stadium in London).

Polyester is the preferred fibre for wide format digital print fabrics on account of the extremely smooth surfaces that can be achieved via either weaving or warp knitting it – especially as there is a general move away from PVC coating in the field.

Despite notable successes, however – including the widespread conversion of the high-end fashion industry centred around Como in Italy to digital technology – screen printing still dominates in the main markets of fashion and home textiles.

Italy represents at most 3% of the world’s printed textiles by volume and although it can boast growth rates of around 25% annually, digital textile printing is still comparatively tiny – representing around just 1.5% of the overall textile printing market.

So as the technology continues to rapidly develop, the digital print machine builders must make headway in the major textile manufacturing countries such as Brazil, China, India and Turkey.

Very much with this in mind, are new machines such as the Avalanche 1000, introduced for the direct-to-garment market by Israel’s Kornit.

Designed for 24/7 mass production operation, systems like this enable a single operator to produce printed garments and fabric cuts at exceptional speeds. In common with all other machines from Kornit that print on a large variety of textiles using a single ink set, the Avalanche 1000 utilises the company’s NeoPigment process which is more environmentally friendly and efficient than machines that require additional pre-treatment and drying processes before being ready for print.

As a textile technology specialist, Kornit has now installed 1,000 of its machines in over 100 countries since it was founded just ten years ago.

In general, however, companies moving into digital textile printing in Europe are coming from different industries such as the graphic arts, sign making, screen printing and general digital printing – areas quite separate to textile manufacturing – and digital printing still faces both economic, and to some degree technical obstacles to achieving mass market acceptance in the larger commodity textiles field.

This is illustrated by its progress to date in the home textiles sector.

The home textiles market includes a broad range of separate industries, but as far as textile printing is concerned, can be broken down into two key categories:

The bulk of home textiles supplied to the major US and European markets are from a number of key screen printing countries. China, India and Pakistan supply around 80% of US home textiles, while China and Pakistan compete with Turkey to supply Europe.

This is an extremely competitive field in which the price for screen printed textiles per square metre is relatively cheap. Prices are kept low by the obvious labour-cost advantages these countries still have, and the large minimum print runs which keep down the initial costs of screen engraving, in addition to other overheads.

It’s true that the latest generation of digital textile printers have considerably increased production speeds and ink and related costs have come down significantly, but so far, attempts by European printers using the technology to compete with the major exporting countries are nowhere close – certainly for long production runs.

For the time being then, digital textile printing is limited to niche fashion and home furnishings markets and the one-off designs for promotional signage, where price premiums can be demanded for small production runs and customised products.

But the technology is moving forward all the time.

It will be interesting too, to see what synergies result following the recent installation of the new digital textile finishing system – ten years in development – at TenCate in the Netherlands.

See: TenCate commences digital finishing of textiles

www.innovationintextiles.com/tencate-commences-digital-finishing-of-textiles

Business intelligence for the fibre, textiles and apparel industries: technologies, innovations, markets, investments, trade policy, sourcing, strategy...

Find out more